How it works

Find out how easy it is to open a splend!t account in just a few steps and apply for a student loan. For investors, the process is equally simple - sign up, find your students and invest in their future.

Finance your studies in 4 easy steps!

Finance students in 3 easy steps!

General

About splend!t

splend!t is Switzerland’s first internet platform for the financing of education. We connect students with private investors directly. Our p2p loans give access to students to quick and fair funding for their education. For private investors, we open a new market for sensible and sustainable investments away from traditional capital markets and banks.

Yes of course! Whether you are at a university of applied science or do an advanced training course (e.g. FMH, MBA, MAS/DAS/CAS), you’ve come to the right place! We check with the respective educational institute, whether someone requesting a loan is actually registered. Should we not know the educational institute or course yet, we will be happy to learn more about it with your help.

Yes, we can! Get in touch with us on info@splendit.ch and send us an apostilled copy of your passport via mail or register on lend.ch as an investor and we'll manually enable you as a user and once we've verified all documents open your auction for funding.

Funding international students can be cumbersome in the old world and cross border transactions are costly. This is why we've decided to do all cross border transactions via the Lykke blockchain wallet. Simply download the Lykke app and open your blockchain wallet. Once your auction is successfully funded, we will credit your blockchain wallet with the loan amount. You can then transfer it to your bank account overseas.

p2p or peer-to-peer loans are private loans directly between private individuals. Direct transactions have been a promising innovative and growing trend in the internet. Investors decide for themselves whom they lend their money and make a sensible and profitable investment at the same time. Borrowers - and in our case students - have access to quick and easy financing for their education at favourable rates. There are no cost intensive structures as know from banks and credit institutes.

splend!t facilitates educational loans in a simple and efficient manner between private individuals. We operate at lower costs than banks and pass the savings on to students with lower rates and to investors with solid returns.

splend!t does not make money from high interest rates, we only charge a fee that is not linked to the interest. The rate is worked out based on supply and demand in an auction and your marks, curriculum vitae and quality of your credit request will be important to gain the trust of the investor community which will ultimately determine your interest rate.

splend!t does not make money from high interest rates, we only charge a fee that is not linked to the interest. The rate is worked out based on supply and demand in an auction and your marks, curriculum vitae and quality of your credit request will be important to gain the trust of the investor community which will ultimately determine your interest rate.

splend!t charges a small fee for quality assurance, the monitoring and processing of all payments as well as the support of our splend!t members.

Students are charged a monthly platform fee of CHF10 during the lifetime of their loan. Investors pay a one time 2% upfront fee of their investment at the beginning of a loan.

Fees are charged in addition and specified separately.

Students are charged a monthly platform fee of CHF10 during the lifetime of their loan. Investors pay a one time 2% upfront fee of their investment at the beginning of a loan.

Fees are charged in addition and specified separately.

splend!t is run by Switzerlend AG in Zurich. Its founders are Michel Lalive d’Epinay and Florian Kübler. Check out the "About us" section for a bit more color on us.

Splendit works with eggheads.ch, a Swiss startup which lists over 1'500 courses for education and further education that can be rated by graduates. These independent ratings show what the benefit of a course really is. We therefore recommend that the ratings are consulted by students before signing up to a specific course. Also, the rating should help investors in their investment decisions.

Privacy and security

We treat personal data with the required confidentiality at all times. Transactions and data are processed and stored according to state of the art security standards. Our servers are located in Switzerland and data is transmitted SSL-encrypted to protect from unauthorised access by third parties. For more background please read the "Datenschutzerklärung" which is part of the AGB.

Members of splend!t remain anonymous to the outside and amongst each other. Only upon sucessful conclusion of an educational loan, the identity will be disclosed between the contracting parties. Splend!t has access to all data of its members and treats these confidentially.

However, members can upload a profile picture of themselves viewable to everyone. Many students prefer to disclose their identity upfront as it gives lenders more comfort to invest. We believe that adding a profile picture (and possibly other information about yourself) can create trust of investors and improve the terms of a loan. It is up to you to decide how much of your identity you would like to reveal.

However, members can upload a profile picture of themselves viewable to everyone. Many students prefer to disclose their identity upfront as it gives lenders more comfort to invest. We believe that adding a profile picture (and possibly other information about yourself) can create trust of investors and improve the terms of a loan. It is up to you to decide how much of your identity you would like to reveal.

We process all payments through the execution and settlement account of Switzerlend AG at PostFinance (CH 68 0900 0000 1529 3319 6). This account is fully segregated from any other company or business accounts of Switzerlend AG. Its sole purpose is to serve as an execution and settlement account between the members and with splend!t.

Registration and identification

There are two types of members at splend!t, Full Users and Light Users. They are comparable to active and passive members in a club. While a Light User can has completed the first step to the registration, requesting a loan or financing students is reserved for Full Users.

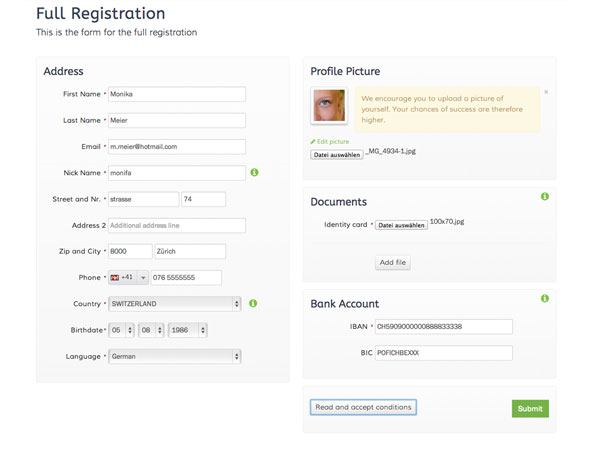

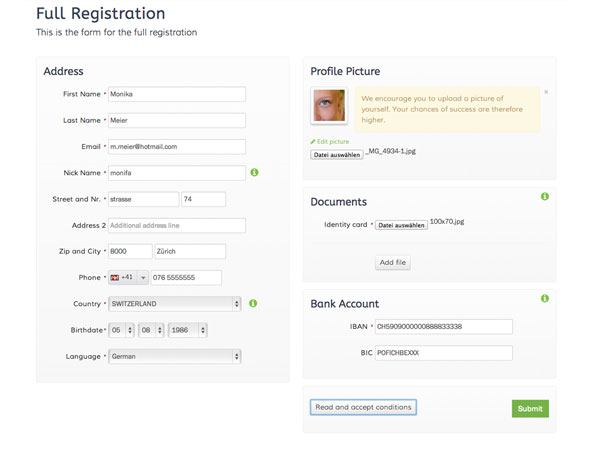

To become a Light User simply register your email address with a password and complete your registration by clicking the confirmation link we send to your email account. Then you register as student or investor (Full User). You need a splend!t account and we have to clearly identify you. We need

(1) a clear closeup photo of your ID/passport,

(2) a clear closeup photo of your face with your ID/passport held next to it; and

(3) payment of your identification fee (CHF 5) from your personal bank account.

We then cross-check the details of your ID/passport with the details of the sender of the identification fee. If they match we will activate your splend!t account and you are good to go. If you don't have a bank account in Switzerland, send us an appostilled copy of your passport via mail and we'll manually enable you as a user.

To become a Light User simply register your email address with a password and complete your registration by clicking the confirmation link we send to your email account. Then you register as student or investor (Full User). You need a splend!t account and we have to clearly identify you. We need

(1) a clear closeup photo of your ID/passport,

(2) a clear closeup photo of your face with your ID/passport held next to it; and

(3) payment of your identification fee (CHF 5) from your personal bank account.

We then cross-check the details of your ID/passport with the details of the sender of the identification fee. If they match we will activate your splend!t account and you are good to go. If you don't have a bank account in Switzerland, send us an appostilled copy of your passport via mail and we'll manually enable you as a user.

To use splend!t for real you need a splend!t account and we need to clearly identify you. Makes sense if you think of it because you can request or provide financing for a loan. We need (1) a clear closeup photo of your ID/passport and (2) your face with your ID/passport held next to it and (3) payment of your identification fee (CHF 5) from your personal bank account. We then cross-check the details of your ID/passport with the details of the sender of the identification fee. If they match we will activate your splend!t account and you are good to go. Students don't need a bank account in Switzerland and can become full users by sending us an appostilled copy of their ID.

If you only register with your email address only ("Light User") you are not yet permitted to use splend!t for real.

If you only register with your email address only ("Light User") you are not yet permitted to use splend!t for real.

We need your bank details to identify you and to execute and settle payments. In case of a successful conclusion of an educational loan we transfer the investors’ money to the student’s bank account. Equally, we transfer the interest and amortization payments from students to investors during the life of the loan.

Students

First steps

Loans for education that do not require amortization from day one are practically non-existent in Switzerland. Banks lend very selectively and at high interest rates. Scholarship funds and other subsidies are selectively granted and difficult to access. MBA's can be very costly and often students have not saved up enough funds to pay for the full tuition. At splend!t you can apply for an educational loan in an simple and non-bureaucratic way – all online! Save yourself a trip to the bank or scholarship office.

Yes of course! Whether you are at a university of applied science or do an advanced training course (e.g. FMH, MBA, MAS/DAS/CAS), you’ve come to the right place! We check with the respective educational institute, whether someone requesting a loan is actually registered. Should we not know the educational institute or course yet, we will be happy to learn more about it with your help.

You have to be 18 or older and enrolled in an education.

We need your bank details to identify you and to execute and settle payments. In case of a successful conclusion of an educational loan we transfer the investors’ money to the student’s bank account. Equally, we transfer the interest and amortization payments from students to investors during the life of the loan. International students are financed via their blockchain wallet on Lykke. Repayments can be executed via Paypal, bank- or blockchain transfer.

splend!t is free of charge as long as you do not have an educational loan outstanding! During the lifetime of a loan, we charge a monthly platform fee of CHF 10 that we invoice quarterly.

Your registration, our review of your credit request as well as running an auction are all free of charge. Only when registering you have to transfer an identification fee (CHF 5) from your personal bank account. However, this is a one off payment to verify your identity. If you are an international student and send us an appostilled copy of your ID, the registration is free of charge.

Your registration, our review of your credit request as well as running an auction are all free of charge. Only when registering you have to transfer an identification fee (CHF 5) from your personal bank account. However, this is a one off payment to verify your identity. If you are an international student and send us an appostilled copy of your ID, the registration is free of charge.

Open a credit request

It is a pure online process and we will guide you through the individual steps.

Registration. Sign up with your email address and a password and complete your registration by clicking the confirmation link we send to your email account. You are now a Light User and can view auction details and attachments.

To create and publish a credit request you need a splend!t account as a student and we have to clearly identify you. We need (1) a clear closeup photo of your ID/passport and (2) your face with your ID/passport held next to it and (3) payment of your identification fee (CHF 5) from your personal bank account. We then cross-check the details of your ID/passport with the details of the sender of the identification fee (CHF 5). If they match we will activate your splend!t account and you are good to go. Alternatively you can send us an appostilled copy of your ID and we can identify you that way.

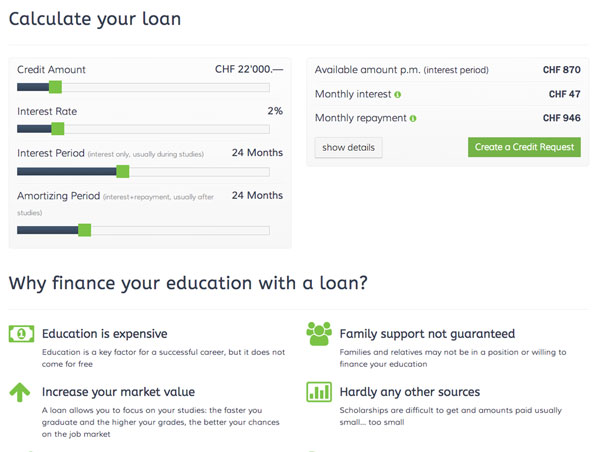

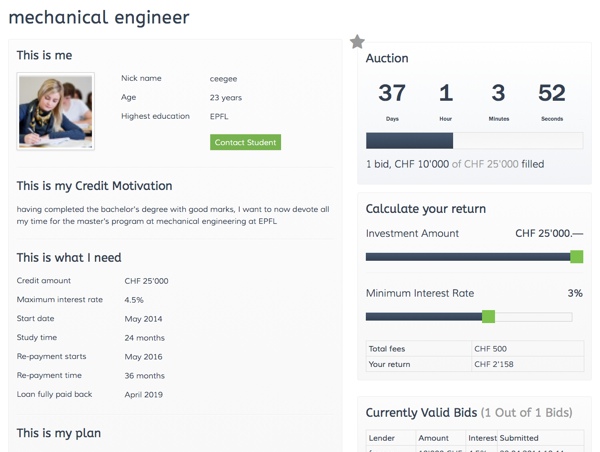

Request. Submit your request with our splend!t online form. You choose the credit amount, the maximum interest you are willing to pay and the term of your loan. Provide more information about your education, your motivation, the reason for your credit request as well as your plans after your studies. Make sure you upload proof of your enrolment (e.g. confirmation from the educational institute) and upload school reports and diplomas such as Matura report, Bachelor’s diploma, apprenticeship report etc. We will check these references with the respective institutes and make sure your request is complete. Feel free to add any other information you think may improve your chances to receive a loan at all or at better rates.

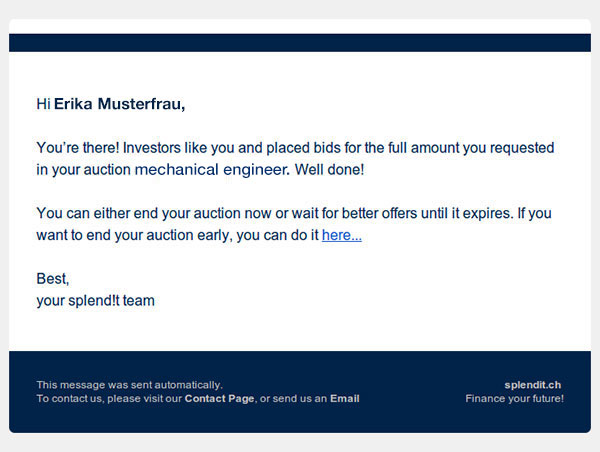

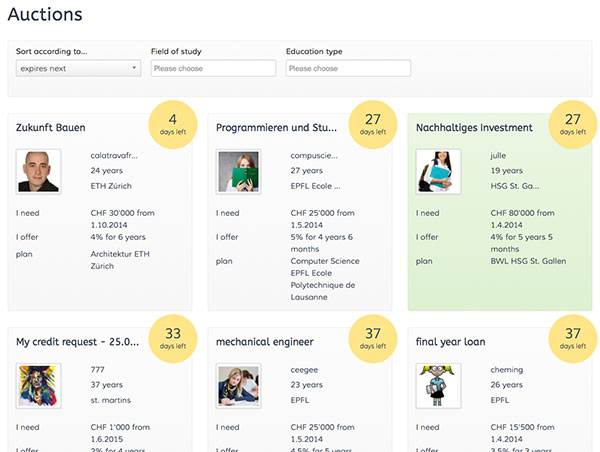

Auction. After a successful review of your request by splend!t you can publish your request. The auction will now appear on our website and investors can now finance your future!

Registration. Sign up with your email address and a password and complete your registration by clicking the confirmation link we send to your email account. You are now a Light User and can view auction details and attachments.

To create and publish a credit request you need a splend!t account as a student and we have to clearly identify you. We need (1) a clear closeup photo of your ID/passport and (2) your face with your ID/passport held next to it and (3) payment of your identification fee (CHF 5) from your personal bank account. We then cross-check the details of your ID/passport with the details of the sender of the identification fee (CHF 5). If they match we will activate your splend!t account and you are good to go. Alternatively you can send us an appostilled copy of your ID and we can identify you that way.

Request. Submit your request with our splend!t online form. You choose the credit amount, the maximum interest you are willing to pay and the term of your loan. Provide more information about your education, your motivation, the reason for your credit request as well as your plans after your studies. Make sure you upload proof of your enrolment (e.g. confirmation from the educational institute) and upload school reports and diplomas such as Matura report, Bachelor’s diploma, apprenticeship report etc. We will check these references with the respective institutes and make sure your request is complete. Feel free to add any other information you think may improve your chances to receive a loan at all or at better rates.

Auction. After a successful review of your request by splend!t you can publish your request. The auction will now appear on our website and investors can now finance your future!

Your loan is funded by private individuals who prefer to directly support a student rather than investing indirectly in abstract financial products. Financing someone’s education is sensible, sustainable and an investment into the future – the future of students and Switzerland.

During the interest-only period all you pay is interest on your credit amount. Only when the amortization period starts you start amortizing your loan.

You choose the length of both periods and time them to your education and individual circumstances. Ideally the interest-only period is at least as long as your education. We generally recommend adding a time cushion after your studies to find the right job before you have to start amortizing your loan.

You choose the length of both periods and time them to your education and individual circumstances. Ideally the interest-only period is at least as long as your education. We generally recommend adding a time cushion after your studies to find the right job before you have to start amortizing your loan.

The interest rate is set in your auction by the bids of the investors. A bid with a lower interest wins, at identical interest rates the bid placed earlier wins. In any event the interest rate will never be higher than the maximum rate you set in your credit request, but may be lower depending on the bids placed by investors. If you manage to attract many investors who outbid each other, your interest rate will drop.

The better your past school reports, the more transparent your credit request and profile and the more investors believe you will actually repay their investment and on time, the lower the interest rate will be.

Be reasonable when setting the maximum interest rate. You do not want to publish an auction where no investor is interested. Try to set the maximum interest rate at a reasonable level.

The better your past school reports, the more transparent your credit request and profile and the more investors believe you will actually repay their investment and on time, the lower the interest rate will be.

Be reasonable when setting the maximum interest rate. You do not want to publish an auction where no investor is interested. Try to set the maximum interest rate at a reasonable level.

You define the preferred pay-out month in your credit request. In contrast to a consumer loan, requesting a student loan is generally a well thought-through decision that you want to plan early on. With splend!t you can submit a credit request months before you actually start studying and request the pay-out month fitting to the start date of your education.

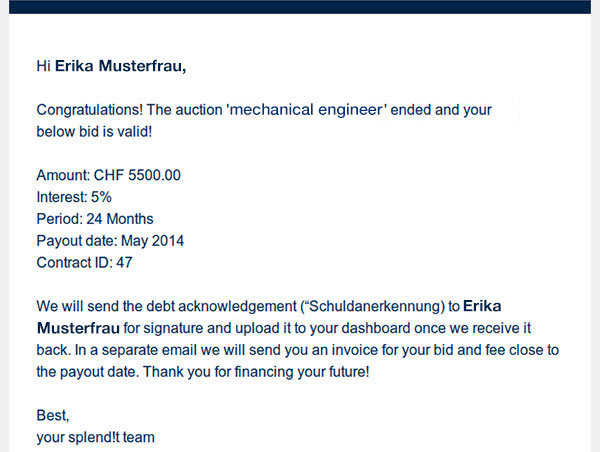

With the pay-out month approaching we will request payment from the investors and transfer the credit amount to your account as soon as all investors have made their payment. That is when your loan starts to run.

With the pay-out month approaching we will request payment from the investors and transfer the credit amount to your account as soon as all investors have made their payment. That is when your loan starts to run.

Repayment

You set the terms of your loan! This goes for the amortization period too. The amortization period follows the interest only period. Ideally you start amortizing your loan after you finished your education, started working and are making an income. We generally recommend adding a time cushion after your studies to find the right job before you have to start amortizing your loan.

Make all payments electronically to the execution and settlement account of Switzerlend AG (IBAN CH68 0900 0000 1529 3319 6). You will see all your invoices in your splend!t account. We also send them to you via e-mail to remind you.

Yes! You can repay the entire loan at any time. Should the paid interest of your loan not yet cover the total fee of the investor, you will be charged to make up for the balance of this fee. Example: A Lender invests CHF 10'000 (upfront fee investor CHF 200). You decide to repay the loan early (interest paid to investor CHF 50) -> You will have to pay CHF 10'150 to repay the full loan. Once the paid interest is higher than the investor's upfront fee, no additional cost is due.

You will automatically be in default on expiry of the deadline for your payment. We will initiate the formal reminder process and send a first reminder setting an appropriate new deadline for your payment. Any further reminders will trigger reminder charges and we may, on behalf of the investors, even terminate your loan early as per our General Terms and Conditions. You will have to repay the outstanding loan including accrued interest immediately.

We deliberately keep this process very strict because private loans are about trust and money. Both must to be protected. We hope and are confident that we will have to run through this process in very few cases only.

We deliberately keep this process very strict because private loans are about trust and money. Both must to be protected. We hope and are confident that we will have to run through this process in very few cases only.

Interest and Fees

Your interest rate will be set in your auction by the bids of the investors. A bid with a lower interest wins, at identical interest rates the bid placed earlier wins. In any event the interest rate will never be higher than the maximum rate you set in your credit request, but may be lower depending on the bids placed by investors.

All you have to do is make your quarterly payments on time. We prepare the invoices and upload them to your splend!t account. We also send them to you via email to remind you. You make one payment to our settlement and processing account where we split up the account and make your payments to the investors.

All you have to do is make your quarterly payments on time. We prepare the invoices and upload them to your splend!t account. We also send them to you via email to remind you. You make one payment to our settlement and processing account where we split up the account and make your payments to the investors.

splend!t is free of charge as long as you do not have an educational loan outstanding! During the lifetime of a loan, we charge a monthly platform fee of CHF 10 that we invoice quarterly.

Your registration, our review of your credit request as well as running an auction are all free of charge. Only when registering you have to transfer an identification fee(CHF 5) from your personal bank account. However, this is a one off payment to verify your identity.

Your registration, our review of your credit request as well as running an auction are all free of charge. Only when registering you have to transfer an identification fee(CHF 5) from your personal bank account. However, this is a one off payment to verify your identity.

Splend!t is 100% internet based. All payments are electronic. We invoice our fee with payment slips via email and and you make your payments via e-banking.

To publish a credit request you need a splend!t account and we need to clearly identify you. We need (1) a clear closeup photo of your ID/passport and (2) your face with your ID/passport held next to it and (3) payment of your identification fee from your personal bank account. We then cross-check the details of your ID/passport with the details of the sender of the identification fee. If they match we will activate your splend!t account and you are good to go.

Investors

First things first

Every private individual with a bank account in Switzerland that is willing to make sensible investments can become an investor at splend!t.

Registration. Sign up with your email address and a password and complete your registration by clicking the confirmation link we send to your email account. You are now a Light User and can view auction details and attachments.

To place bids in an auction you need a splend!t account as an investor and we have to clearly identify you. We need (1) a clear closeup photo of your ID/passport and (2) your face with your ID/passport held next to it and (3) payment of your identification fee from your personal bank account. We then cross-check the details of your ID/passport with the details of the sender of the identification fee. If they match we will activate your splend!t account and you are good to go as an Investor.

Bidding. With an active splend!t account as an investor you can browse auctions an actually place bids. Go ahead and finance your future!

Registration. Sign up with your email address and a password and complete your registration by clicking the confirmation link we send to your email account. You are now a Light User and can view auction details and attachments.

To place bids in an auction you need a splend!t account as an investor and we have to clearly identify you. We need (1) a clear closeup photo of your ID/passport and (2) your face with your ID/passport held next to it and (3) payment of your identification fee from your personal bank account. We then cross-check the details of your ID/passport with the details of the sender of the identification fee. If they match we will activate your splend!t account and you are good to go as an Investor.

Bidding. With an active splend!t account as an investor you can browse auctions an actually place bids. Go ahead and finance your future!

It is fully up to you to decide which student (education/age/field of study etc.) you would like to finance at what interest rate. The great thing about p2p lending is, in contrast to financial instruments, that it is you who makes the investment decision and you know where your money goes, as opposed to financial instruments.

We need your bank details to identify you and to execute and settle payments. In case of successful completion of a credit request we transfer the investors’ money to your bank account. Equally, we transfer the interest and amortization payments from you back to investors during the life of the loan.

Yes. The Swiss Financial Market Supervisor Authority FINMA ruled that one person may receive financing from a maximum of 20 individuals. Therefore, the minimum investment amount is 1/20 of the total loan amount. For a student loan of CHF 20'000 the minimum amount is therefore CHF 1'00, higher amounts are a multiple thereof i.e. CHF 2'000, CHF 3'000, CHF 4’000 etc.

splend!t monitors and all payments. Therefore all transactions are done via splend!t’s execution and settlement account at PostFinance. We split up interest and transfer amortization payments of students according to their investment amount. Investors do not need to run after payments.

Students requesting a student loan are required to provide proof of their enrolment (e.g. student ID, confirmation from the educational institute) and upload school reports and diplomas such as a Matura report, Bachelor’s diploma, apprenticeship report. We validate these references with the respective educational institutes. However, the investor decides based on its own assessment which amount at which rate he wants to finance a student loan.

Unforeseeable events may occur during the lifetime of a student loan resulting in default. While we are convinced that students act responsibly and will repay their loan on time, there is always the risk of default and you may lose your entire investment. Therefore we advise investors to diversify their risk by investing in various students.

In any event, investors receive a debt acknowledgement signed by the student they’ve invested in. If worse comes to worst, this will allow you to commence enforcement proceedings and claim your investment.

Unforeseeable events may occur during the lifetime of a student loan resulting in default. While we are convinced that students act responsibly and will repay their loan on time, there is always the risk of default and you may lose your entire investment. Therefore we advise investors to diversify their risk by investing in various students.

In any event, investors receive a debt acknowledgement signed by the student they’ve invested in. If worse comes to worst, this will allow you to commence enforcement proceedings and claim your investment.

First steps

splend!t allows you to make sensible and sustainable investments. You directly help someone to finance his education and make a return by receiving interest on your loan.

splend!t gives you access to a new way of investing, human to human. You know where your money goes and what it is used for. This is completely different from abstract financial products.

Your investment is vital! You are investing into Switzerland’s only natural resource: education! In a nutshell, you finance your future!

splend!t gives you access to a new way of investing, human to human. You know where your money goes and what it is used for. This is completely different from abstract financial products.

Your investment is vital! You are investing into Switzerland’s only natural resource: education! In a nutshell, you finance your future!

splend!t is a platform that facilitates the investing in educational loans only. However, whether it is a university of applied science or an advanced training course (e.g. FMH, MBA, MAS/DAS/CAS), almost any (higher) education can be financed through splend!t.

It is important to understand that you invest in unsecured loans. This means a total loss is possible. While we cross-check with the relevant educational institute if the potential borrower is enrolled, the repayment of your investment is not guaranteed. We therefore recommend diversifying your risk by investing in various students.

It is important to understand that you invest in unsecured loans. This means a total loss is possible. While we cross-check with the relevant educational institute if the potential borrower is enrolled, the repayment of your investment is not guaranteed. We therefore recommend diversifying your risk by investing in various students.

Only private individuals for non-commercial purposes. Investors have to be 18 years or older and have a personal bank account.

We need your bank details to identify you and to execute and settle payments. In case of successful completion of a credit request we transfer the investors’ money to your bank account. Equally, we transfer the interest and amortization payments from you back to investors during the life of the loan.

You only pay if you invest. We charge a 2% upfront fee of your invested amount. This is a one-off payment, no running fees apply!

We wanted our fees to be simple. A one-off upfront fee of 2% is much easier to understand and in most cases cheaper than for example a running fee of 0 .75%. Take for example a standard loan which usually runs for 5 years and the student starts paying back after 3 years. Assume your investment is CHF 6’000. Your 2% upfront fee will be CHF 120, easy! A running fee of 0.75% will amount to about CHF 181.80 and normal people can't calculate that without Excel as you have to factor in the reduction of the loan amount due to amortization payments by the student.

We like transparency and hope you like it too.

We like transparency and hope you like it too.

Invest

Every private individual with a bank account in Switzerland willing to make sensible and sustainable investments can be an investor at splend!t.

Yes. The Swiss Financial Market Supervisor Authority FINMA ruled that one person may receive financing from a maximum of 20 individuals. Therefore, the minimum investment amount is 1/20 of the total loan amount. For a student loan of CHF 20'000 the minimum amount is therefore CHF 1'00, higher amounts are a multiple thereof i.e. CHF 2'000, CHF 3'000, CHF 4’000 etc.

The interest rate is set in an auction by the bids of the investors for which the student set a maximum interest rate for the auction. A bid with a lower interest wins - at identical interest rates the bid placed earlier wins. You should therefore place your bid early in an auction. We will inform you via e-mail in case your bid has been outgunned by another investor.

Student submitting a credit request are required to provide a debt collection register extract, a copy of their entry in ZEK (Verein zur Führung einer Zentralstelle für Kreditinformation), proof of their enrolment (e.g. confirmation from the educational institute) and upload school reports and diplomas such as Matura report, Bachelor’s diploma, apprenticeship report. splend!t will validate these references with the respective institutes. However, it is your decision which student you want to finance with what amount and rate. While we are convinced that students act responsibly and will repay their loan on time, there is always the risk of default and you may lose your entire investment. Therefore we advise investors to diversify their risk by investing in various students.

In any event, investors receive a debt acknowledgement signed by the student they’ve invested in. If worse comes to worst, this will allow you to commence enforcement proceedings and claim your investment.

In any event, investors receive a debt acknowledgement signed by the student they’ve invested in. If worse comes to worst, this will allow you to commence enforcement proceedings and claim your investment.

Interest and fees

splend!t charges a one-time 2% upfront fee of the invested amount. There are no running fees for the investor.

We value simplicity and transparency very highly. A 0.75% running fee may look appealing at first glance, but actually costs you more for each loan with a period of 3 years or more. Better to pay once and to know what costs come with your investment.

Splend!t is 100% internet based. All payments happen electronically. We invoice with payment slips via email and and you make your payments electronically (e-banking).

To place bids you need a splend!t account and we need to clearly identify you. We need (1) a clear closeup photo of your ID/passport and (2) your face with your ID/passport held next to it and (3) payment of your identification fee (CHF 5) from your personal bank account. We then cross-check the details of your ID/passport with the details of the sender of the identification fee (CHF 5). If they match we will activate your splend!t account and you are good to go.

A student will automatically be in default on expiry of the deadline for a payment. We will initiate the formal reminder process and send a first reminder setting an appropriate new deadline for the payment. Any further reminders will trigger reminder charges and we may, on behalf of the investors, terminate the loan of a student early as per our General Terms and Conditions. In such an event a student be obliged to repay the outstanding loan including accrued interest immediately

We deliberately keep this process very strict, because private loans are about trust and money. Both must be protected. We hope and are confident that we will have to run through this process in very few cases only.

We deliberately keep this process very strict, because private loans are about trust and money. Both must be protected. We hope and are confident that we will have to run through this process in very few cases only.